Investing For Beginners: A Comprehensive Guide

There are so many investment options for newbies including Robo-advisors and beginner investors, but where does one start?

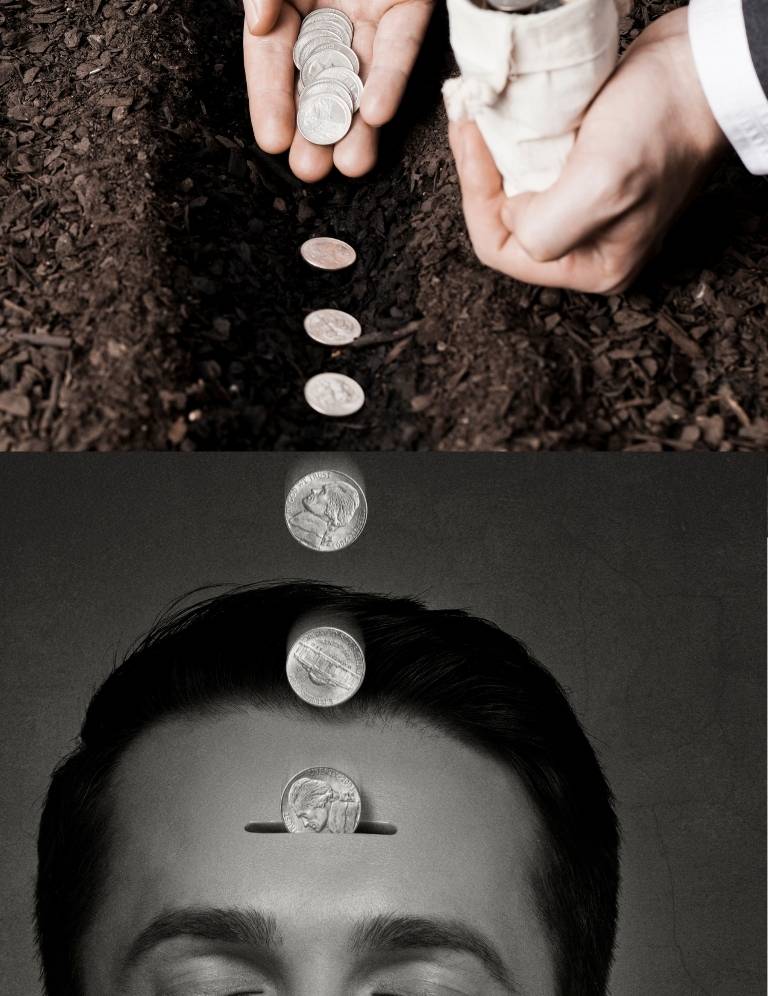

The greatest misconception about investing for beginners is that it’s reserved for only the elite and that you need a ton of money to start investing. This could have been true ten years ago but not in today’s time.

All the barriers to entry have been kicked out by technology and development in the sector. With all these advancements there’s no excuse for beginners to not invest, so follow these tips and start building your wealth.

#1 The Best Golden Rule of Investing

The rule states that you should never lose money. This rule was created by the investment guru Warren Buffet who has amassed a fortune of wealth by applying this rule. The best way to do this is by investing at attractive prices when an option is undervalued.

By doing this you will be paying less than the real price which could later earn you some serious money when normalcy resumes. As much as risk-taking is great, make sure you only take calculated risks. Avoid short-term investing as it is highly risky, look for long-term investment options with secure returns to minimize risks.

Warren Buffet has built his wealth through long-term investing as opposed to short-term trading. Well, some people have hit the jackpot through speculation, but, an even larger number of people have lost money in the same way. In short-term trading, there are multiple costs that are charged in fees and many uncertainties that could result in huge losses.

Many other billionaires have acquired their money through this longer-term trading which has proven to be more essential over the years.

Before investing make sure the investments are made on the best stock that is available to buy. Financial investments carry huge market risks. Make sure your stock investments are stable in the market. Make sure to check your financial account regularly to keep track of market stocks and what return your investments are bringing in.

#2 Build a Portfolio Plan

When you are starting out define your goals, that is how much money you want to make with your business in the long run. Where would you want to be financially? What would you desire your net worth to be? Ask yourself such questions pre-hand then create a plan for getting there. Once that is done, identify the investment options that are lucrative and whose return rate would give you the earnings you would wish to have within the given timelines.

Use this as your guide when making your investment decisions.

#3 Paper Trading

With paper trading, beginners can build real experience without having to risk real money. This technique allows you to trade and invest in stocks, track profits or losses, and basically do everything you would have done in reality.

Today, many platforms will enable you to practice your skills at no cost at all. Think of this as a training ground before you invest with your real money. I think every beginner should start here, I mean, what’s there to lose?

#4 Stock investing for beginners

As a beginner buying and investing in the stock of a single company can be one of the best ways to invest your money. By investing in the right company you could earn as much as 15% a year. This same strategy that I’m about to show you is the same that investors like Warren Buffet have used to milk the markets for the last six decades. So how does one invest as a beginner? The most important aspect while financial investing and stock investing is choosing the right company and the right time.

This will require you to get to research the selected companies by looking at their past performance, their management, their financial reports, and the moat. Once you have identified a company that meets your qualifications, don’t invest right away.

Place the company on your watchlist for some time. As you wait, keep an eye on price dips. Once the stock price goes down, buy. This will give you a great bargain and profit once the company goes back to its real value. As you invest it is important to keep your emotions in check.

Understand that markets are very volatile and even the best companies may experience dips. Don’t panic or make hasty decisions based on any drastic changes. Instead, wait, be patient and analyze the situation before making a decision. Never let fear be the driving factor behind a decision to buy or sell. Often if not always you will be wrong and will be doing exactly what the market wants you to. The beauty of investing today is that you don’t need a lot of money.

You can start with as little as a thousand dollars and grow your account to tens of thousands in a short time. As you invest ensure, you avoid penny stocks. Penny stocks are the stocks of companies that are valued under five dollars. These stocks can be attractive as they are lowly priced. However, they are very volatile, and little to no information about the companies is available online. Most penny stocks are for small companies that are relatively new in the public sphere.

#5 Investing Apps

Technology has come in to save the day, or rather save newbie investors. Today there are numerous financial investing apps that get to target beginners. Some even round up your purchases on credit or debit purchases and invest them in a portfolio of ETFs.

These best financial apps will work like Robo advisors and will manage your portfolio. If you still want to do it for yourself, there are so many apps that will train you and teach you how to invest. Most get to charge very little fees and are convenient as they can be accessed at any time on your devices.

#6 ETFs

Exchange-traded funds are quite similar to index funds. They also track a specific market index and use the same investing approach. These funds also tend to have fewer fees when compared to mutual funds.

The main difference between the two is that rather than having a minimum investment, the ETF are traded throughout a day and have a share price that fluctuates. This share price is the ETF’s minimum investment amount which can be less than one hundred dollars or even more than three hundred dollars. Since they are traded daily like stock, they incur brokerage fees paid in commissions. Many people have made a lot of money through them, but they require a lot of research and vigilance like stocks do.

To really succeed with them you will need to dedicate a significant amount of time if not a full-time investor.

#7 Index Fund

The easiest way to describe index funds is mutual funds on autopilot. It is a great alternative to hiring a portfolio manager to create one for you. Instead, an index fund will track a specific index. A market index refers to a collection of investments that represent a segment of the total market. A great example is the S&P 500 that holds the stocks of 500 of the biggest companies in America.

The S&P 500 stock fund will mirror the performance of the companies within the category and buy their stocks. The expenses are lower as the funds take a passive approach in investing which involves tracking the overall market index as opposed to having a real professional portfolio manager. Similar to mutual funds, if you invest in index funds you will be purchasing a chunk of the whole market in a single transaction. In many cases, index funds have minimum investment amounts but a couple of brokerage funds have no requirements. How amazing is that?

This investment option is better in the long term.

#8 Target-date Mutual Funds

Mutual fund stock investing is subject to market risk. So buy these stocks carefully. Similar to retirement plans are the target-date mutual funds. This investment option will automatically invest money with the estimated retirement year in mind. A mutual fund is a basket of many investments where an investor buys a share in the fund thereby investing in the total holdings of the fund at a go.

These funds are run by professional managers who choose how the fund will be invested but each fund generally follows a specified theme. For example, an equity mutual fund will invest in stocks. In most cases, you will find the targeted mutual funds holding a mix of bonds and stocks. If one plans to retire in 20 years from 2020, they can select a mutual fund of their preference and it will be labeled 2040. When the term ends the investor will rip from the returns of the investment.

#9 Robo-advisors

Just as the name suggests these are robots that offer financial services such as building portfolios and selecting financial investment options on people’s behalf. If you don’t know much about investing, Robo-advisors are a great option. Robo-advisors will manage all your investments by using computer algorithms.

Their systems incur low overhead costs therefore the fees to operate are relatively lower than hiring brokers to manage your account. It would cost you between 0.25% and 0.50% to use a Robo-advisor and between 0.5% to even 5% to hire a personal financial advisor. When you are a newbie and you don’t have a lot of money this is an easy way out.

But we’re not saying you let them do all the work, you still have to monitor where your money is going and what is happening. If you are also interested in learning some advisors have educational content and useful tools that will help you understand more about the processes involved. It’s a cheaper more convenient and proven way to invest.

#10 Employment Retirement Plans or 401 (K)

A retirement plan is the best place to start as a rookie investor. Some companies will match your contribution; say you contribute 2% of your salary, your company could contribute another 2% equivalent to the amount you put in the plan.

It may seem like a small amount but it’s free money that will grow over the years. Today you can contribute up to 19500$ in your 401 (k) and 26000$ if you are above the age of 50. The beauty of this investment plan is that there’s no minimum deposit required you can start with as little as you can afford to. When you choose a plan, the amount will be deducted automatically from your account.

Most retirement plan deductions are made pre-tax, so you end up saving a lot more money in the long run. The power of compounding also plays a key role here in growing your money. A little contribution every month can create a pool of money in a couple of years through compounding.

Still not sure about this? Head over to your HR department for more information. All in all, follow our short guide for investing and you should be alright. With that said, where will you be starting your investment journey?